Milgard Center for Financial Wellness launched

The new Center for Financial Wellness at the University of Washington Tacoma’s Milgard School of Business is working to change how we talk about money.

Many college students and young adults are facing serious financial burdens and lack an understanding of their personal finances because it is often not taught at any educational level. The Center for Financial Wellness (CFW) at the University of Washington Tacoma’s Milgard School of Business is working to change how we talk about money.

The CFW has two distinct directives: Financial Literacy led by Director Hui Suk So and Financial Wealth Creation led by Director Dr. Fei Leng.

Thanks to a generous donation from Sound Credit Union, the Center offers accessible financial literacy workshops, discussing economic justice, mobility, and wealth creation. The center was also able to award up to $15,000 in Financial Wellness Scholarships to 10 deserving UW Tacoma students this academic year.

Financial wellness events are open to all students and to the public. A variety of topics are discussed such as: How to create and balance a budget, understand your credit score and manage credit, buying a car, managing money during uncertain times, investing, banking tools, and first-time home buying to name a few. With so many students managing to take college courses, work part time, and prepare to pay off student debt, it’s critical to give them the confidence to make educated financial decisions for themselves and their families.

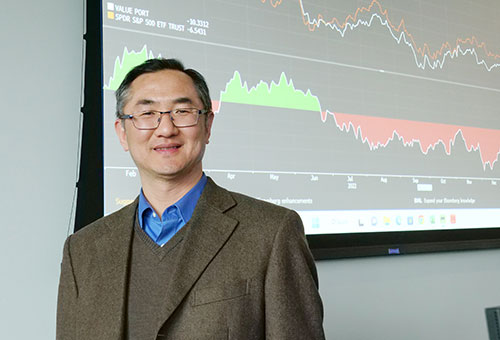

The Wealth Creation initiative includes the new Financial Wellness Lab — the first of its kind within the University of Washington system. The lab is equipped with a stock ticker showing real time financial data (generously provided by the Bates family), a world clock, and four Bloomberg Terminals funded by Sound Credit Union.

Starting spring quarter, students can gain hands-on experience on being able to monitor and manage real-time financial data, earn a future Bloomberg Terminal Certification, perform market, industry, and company analyses of large U.S. companies, perform and build financial modeling, and learn to analyze, build, and manage investments/portfolios responsibly in a safe setting. The Bloomberg research tools can be integrated into many business disciplines and are expected to bolster student resumes and performance in internships.

An official lab ribbon cutting ceremony is planned for Oct. 3, 2023. You can find other upcoming Financial Wellness Events here. Events are open to the public but advanced registration is encouraged.