Main Content

Overview

UW divides its accounting records into periods consisting of two fiscal years, called a "biennium." Fiscal Year 2024 will end on June 30th, 2024, and is the first year of the current biennium. Looking ahead, Fiscal Year 2025 will start on July 1, 2024 and is the second year of the current biennium.

After the fiscal year ends, accounting records are finalized and closed, while a new set of records is opened for the new fiscal year. For a short time, two separate sets of records are open. This time is called crossover and lasts throughout July. All resources are affected by fiscal year crossover and closing processes. The following information has been gathered from various sources and tailored to our campus.

Reminders:

- Due to crossover, Workday may not display beginning balance or transaction amounts at all or correctly. Beginning balances are not final until after all closing calculations are complete. We anticipate that beginning balances for gift and self-sustaining resources may not be available until August 2024.

- In rare occasions, transfers after the end of the fiscal year (grant or revenue resources) can occur and may impact allocated GOF, DOF, SAFC, or STFC resources. Since all unspent allocations are swept to their respective reserves during closing, any impact of post-closing transfers will also be swept to central and will not impact FY24 spending authority.

How to prepare

- Complete Reconciliation – While on-going reconciliation is encouraged every month, all schools and units should ensure resources are reconciled to identify required transfers and corrections and submit them before cut-off deadlines.

- Review Open Balances – Review encumbrances and open balances, and if applicable, request closures to limit erroneous balances into the new year.

- Plan Year-End Purchases – Coordinate to ensure that actions are taken in advance if you intend to have expenses post to the expiring fiscal year. Services and supplies must be physically received and processed before cut-off deadlines. Items received and/or invoiced after these dates may post to FY24.

- Forecast Year-end Spending – Determine probable overspends at fiscal year-end based on forecasting remaining spending. Once identified, please email tacfiscal@uw.edu as soon as possible so we can assist with the resolution.

- Review Year-end Transactions – Final postings for year-end processes post in July and should be reviewed to ensure accuracy. The final payroll (June 16th – 30th) should be posted by July 5th. Correcting transfers must be submitted by cut-off deadlines.

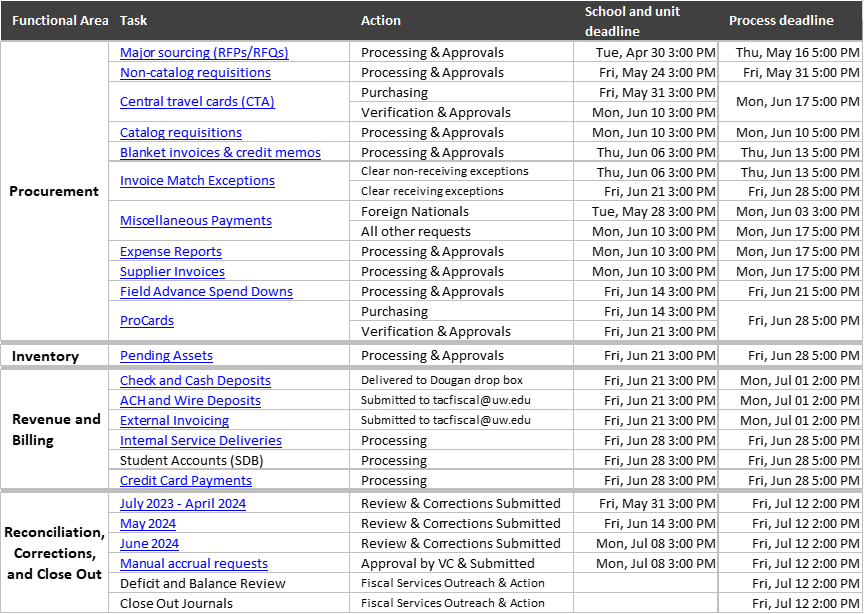

Year-end close deadlines

These deadlines accommodate UW Seattle central office timelines and provide allocations for Fiscal Services review and processing. To the extent possible, taking action well in advance will assist with ensuring timely processing. Fiscal Services will process all items received by the respective task school/unit deadline. Requests received after the school/unit deadline but before the process deadline may be accommodated as capacity allows -- there is no guarantee these requests will be processed.

Click on the image below to download a deadline summary PDF.

Clarifications on Institutional Reserves and Commitments processes

Schools and units may recall prior iterations of the reserves and commitments (also known as carryforwards) request process that operationalized our current policy. As a result of the significant changes in our financial systems, the following clarifications will now guide our processes.

Dean’s Carryforward for Special Projects

No request necessary

Fiscal Services will include initial allocations of $50,000 for each school during the annual budget development process. With the approval of the Chancellor and confirmation of remaining GOF funds after fiscal year close, up to $50,000 will be funded in the subsequent fiscal year.

Start-up and offer letter commitments

No request necessary

Due to changes in how Workday Finance operates, Fiscal Services can now fund start-up and offer letter commitments funded from central resources at the time of issuance using stand alone grant worktags. Allocations for school or unit funded start-up and offer letter commitments can be transferred from existing school or unit resources to the stand alone grant worktag at the request of the cost center manager.

Residual balances in these identified stand alone grant worktags will not be swept at fiscal or biennium end and will remain available through the timeframe detailed in the offer letter.

Incurred or legally obligated expenses

Requests that exceed $4,999* and meet the criteria listed below must be approved by the appropriate Vice Chancellor (or their designee) and submitted to tacfiscal@uw.edu by Monday, July 8th at 3:00pm. *FY24 Clarification: Due to continued Workday stabilization, the dollar threshold is waived for FY24 to assist in getting appropriate expenses posted.

As a result of Workday, Fiscal Services can now process accruals. An accrual, or accrued expense, is a means of recording an expense that was incurred in one accounting period but not paid until a future accounting period. Recording an accrual ensures that the transaction is recognized in the accounting period when it was incurred, rather than paid. Since expenses can be recorded using accruals in the appropriate fiscal year, carryforward requests are no longer necessary. An accrual request is not needed for fully approved purchase orders and invoices if the goods or services have been received and any receiving match exceptions are cleared by Friday, June 28th at 5:00pm. Workday will automatically create accruals in these circumstances.

For items not automatically accrued by Workday, Fiscal Services will process manual accrual journal entries. In order for an expense to be recorded in the expiring fiscal year, the expense should have been incurred by June 30, meaning that the goods should have been received or services should have been rendered by that date. The following examples warrant appropriate justification for an accrual.

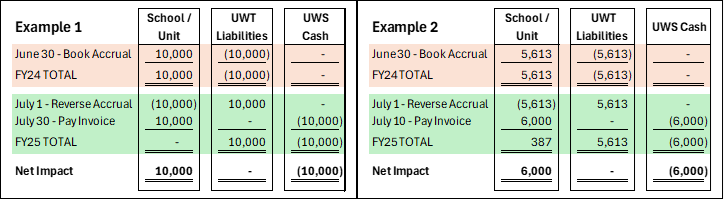

- Example 1: A purchase order for equipment is issued in Workday on June 1, and the equipment is physically received on June 28. The vendor submits an invoice on July 3 and is paid on July 30. An accrued expense of $10,000 must be recorded as of June 30.

- Example 2: A bill for $6,000 is received on July 3. The dates of service are from June 2 – July 2. An accrued expense of $5,613 must be recorded as of June 30 since ~94% of the time of service occurred in June.

When recording an accrual, the school/unit resource is debited, and a central accrued expense liability ledger is credited. All accruals recorded in June will automatically reverse in July. The image below illustrates the accounting treatment for the provided examples and the impacts on the expiring and new fiscal years.

Who should I email?

To ensure a timely response during fiscal year end, direct all questions and submissions to tacfiscal@uw.edu.

Fiscal Services staff will route your email to the most appropriate team member to handle your query.